How to Make Mobile Check Deposits – Mobile check deposits have revolutionized the way we manage our finances, allowing users to conveniently deposit checks from their smartphones without the need to visit a bank branch.

This guide will walk you through the process of making mobile check deposits, covering essential steps, tips for successful deposits, and addressing common concerns related to security and limitations.

What is Mobile Check Deposit?

Mobile check deposit is a feature offered by many banks and credit unions that enables customers to deposit checks using their mobile devices.

By leveraging the camera on your smartphone or tablet, you can take pictures of the front and back of a check and submit them electronically to your financial institution. This process not only saves time but also enhances convenience, especially for those with busy schedules or those living in areas with limited banking facilities.

Benefits of Mobile Check Deposits

Before diving into the step-by-step process, let’s explore some of the benefits of using mobile check deposits:

- Convenience: You can deposit checks anytime and anywhere, as long as you have your mobile device and internet access.

- Time-Saving: Say goodbye to waiting in line at the bank. Mobile check deposits allow you to complete transactions quickly from the comfort of your home or while on the go.

- 24/7 Accessibility: Mobile deposits can be made at any time, even outside of normal banking hours.

- Immediate Confirmation: Many banking apps provide instant notifications confirming your deposit, giving you peace of mind.

How to Make a Mobile Check Deposit

Step 1: Check Your Bank’s Requirements

Before initiating a mobile deposit, ensure that your bank or credit union offers this feature. Most major banks provide mobile check deposit through their apps. Verify if your account is eligible for mobile deposits and familiarize yourself with any specific requirements your institution may have.

Step 2: Download and Open Your Bank’s Mobile App

If you haven’t already, download your bank’s mobile application from the App Store (iOS) or Google Play Store (Android). Once installed, open the app and log in using your credentials. If your bank uses biometric authentication, such as fingerprint or facial recognition, you can use this feature for quicker access.

Step 3: Endorse the Check

Before taking photos of the check, ensure that you properly endorse it. This typically involves signing your name on the back along with a note specifying that it is for mobile deposit only. For example, you might write “For mobile deposit at [Your Bank’s Name] only.” This step is crucial as it helps prevent fraud.

Step 4: Select the Mobile Deposit Option

Within your bank’s app, look for the option to deposit a check. This may be labeled as “Deposit Checks” or “Mobile Deposit.” Tap that option to proceed.

Step 5: Enter the Check Amount

You will be prompted to enter the amount of the check you are depositing. Ensure that the amount you input matches the figure written on the check to avoid any discrepancies.

Step 6: Capture Images of the Check

The app will guide you through taking pictures of the check. Here are some tips for taking clear photos:

- Flat Surface: Place the check on a flat, well-lit surface.

- Focus: Make sure the camera is focused clearly on the check.

- Corners in View: Ensure all four corners of the check are visible in the image.

- No Glare: Avoid glare or shadows that can obscure any part of the check.

Take photos of both the front and back of the check, following prompts from the app.

Step 7: Review and Submit

After capturing the images, review the information you entered, including the check amount and the images of the check. Ensure everything is correct before proceeding. Once confirmed, submit the deposit.

Step 8: Keep the Check for a Period

Most banks recommend keeping the physical check for a period (usually around 14 days) after making the mobile deposit. This allows you to verify the transaction and provides a backup in case any issues arise. After this period, you can safely dispose of the check, preferably by shredding it to protect your personal information.

Common Issues and Troubleshooting

Even with the convenience of mobile check deposits, users may encounter some common issues. Here are a few potential problems and their solutions:

- Failed Deposit: If your deposit fails, check the app for any error messages. Common issues include unclear images, incorrect amounts, or issues with your internet connection. Recheck the images and try again.

- Delayed Processing: Deposits may not be available immediately. Banks typically have cut-off times for processing deposits, and checks may take a few business days to clear. Always confirm your bank’s policy regarding the availability of funds.

- Deposit Limits: Many banks impose daily and monthly limits on mobile deposits. Make sure to be aware of these limits to avoid unexpected declines.

- Technical Issues: If the app crashes or you experience other technical difficulties, try restarting your device or updating the app to the latest version. If problems persist, contact your bank’s customer support for assistance.

Security Considerations

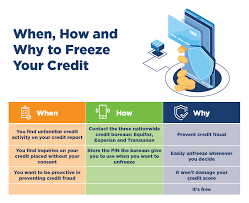

While mobile check deposits are generally secure, it’s important to take precautions to protect your financial information. Here are some security tips:

- Use Trusted Networks: Avoid making mobile deposits over public Wi-Fi networks. Instead, use a secure, private internet connection.

- Enable Two-Factor Authentication: If available, enable two-factor authentication for your banking app to add an extra layer of security.

- Update Your Software: Keep your mobile operating system and banking app up to date to benefit from the latest security features.

- Monitor Your Account: Regularly check your bank statements and account activity for any unauthorized transactions.

Conclusion

Mobile check deposits offer a seamless and convenient way to manage your banking needs. By following the steps outlined in this guide, you can easily deposit checks from your smartphone, saving time and enhancing your overall banking experience.

As technology continues to evolve, mobile banking features like check deposits will likely become even more integral to how we handle our finances. Embrace the convenience while also staying vigilant about security to enjoy a hassle-free banking experience.