Best Medicare Supplement (Medigap) Companies – Navigating Medicare can be daunting, especially for those entering or nearing retirement. With the complexities of healthcare and the ever-changing landscape of insurance options, understanding Medicare Supplement plans, commonly known as Medigap, is essential. This article explores the best Medigap companies of 2024, providing insights into their offerings, advantages, and considerations for potential enrollees.

Understanding Medicare Supplement Plans

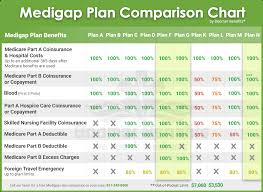

Before diving into the top companies, it’s crucial to understand what Medigap plans are. Medigap policies are private insurance plans that help cover some of the out-of-pocket costs associated with Original Medicare (Parts A and B). These costs can include deductibles, copayments, and coinsurance, making Medigap an attractive option for many beneficiaries.

Types of Medigap Plans

Medigap plans are standardized into various lettered plans (A through N) by the federal government. Each plan offers different benefits but must adhere to specific rules regarding coverage. For example:

- Plan A: Basic benefits, including coverage for Medicare Part A coinsurance and hospital costs.

- Plan G: Comprehensive coverage, excluding the Part B deductible.

- Plan N: Offers lower premiums but requires copayments for some services.

Choosing the right plan involves weighing the benefits against the costs, which can vary significantly among providers.

Top Medigap Companies for 2024

Several companies stand out in the Medigap market based on a combination of factors such as customer satisfaction, plan variety, pricing, and financial stability. Below are some of the best Medicare Supplement companies for 2024.

1. AARP/UnitedHealthcare

Overview: AARP, in partnership with UnitedHealthcare, is one of the largest and most recognized providers of Medigap plans.

Strengths:

- Broad Plan Options: A variety of plans, including G, N, and high-deductible options.

- Competitive Pricing: Generally offers lower premiums compared to other insurers.

- Additional Benefits: Members may access wellness programs and discounts on health-related products.

Considerations: While AARP/UnitedHealthcare offers a robust selection, some may find that customer service varies by location.

2. Mutual of Omaha

Overview: Mutual of Omaha has a long-standing reputation in the insurance industry and provides a range of Medigap plans.

Strengths:

- Strong Financial Stability: An A+ rating from A.M. Best indicates a solid financial foundation.

- Good Customer Service: High customer satisfaction ratings, particularly in claims handling.

- Flexible Plans: Various plan options, including Plan G and N, with competitive pricing.

Considerations: Availability of plans can vary significantly by state, so it’s essential to check locally.

3. Cigna

Overview: Cigna has carved a niche in the Medicare Supplement market with a focus on customer care and comprehensive coverage.

Strengths:

- Comprehensive Coverage: Offers multiple plan options, including Plan G and N.

- Additional Perks: Includes benefits such as access to fitness programs and a 24/7 health line.

- Strong Online Tools: User-friendly website for plan comparisons and policy management.

Considerations: Premiums may be higher than average, so it’s crucial to evaluate the costs against benefits.

4. Anthem Blue Cross Blue Shield

Overview: As a major player in the health insurance space, Anthem offers a wide array of Medigap plans across many states.

Strengths:

- Extensive Network: Large provider network, which can be beneficial for those with specific healthcare needs.

- Variety of Plans: Offers a full range of Medigap plans, including high-deductible options.

- Strong Customer Service: High ratings for customer support and assistance.

Considerations: The availability of plans can vary, and some beneficiaries may encounter higher premiums.

5. Humana

Overview: Humana is well-known for its Medicare Advantage plans but also offers robust Medigap options.

Strengths:

- Innovative Benefits: Humana often includes wellness programs and discounts on healthcare services.

- Flexible Plans: A range of Medigap plans to meet diverse needs.

- Good Reputation: Consistently high ratings for member satisfaction and claims processing.

Considerations: Premiums can be competitive, but it’s essential to compare plans thoroughly.

Factors to Consider When Choosing a Medigap Provider

When selecting a Medicare Supplement plan, various factors should influence your decision:

1. Coverage Options

Different companies offer different plans. Ensure the provider you choose offers the specific Medigap plan that best suits your healthcare needs.

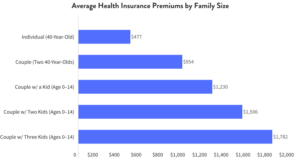

2. Premium Costs

Premiums can vary significantly between companies for the same plan. Request quotes and compare costs, keeping in mind that the cheapest option may not always provide the best coverage.

3. Customer Service

Research customer satisfaction ratings and reviews. A company with excellent customer service can make a significant difference when navigating claims and coverage issues.

4. Financial Stability

Choose a provider with a solid financial background to ensure that they can meet their obligations to policyholders. Ratings from independent agencies like A.M. Best can provide insight into a company’s financial health.

5. Availability in Your Area

Some companies may not offer Medigap plans in certain states or regions, so it’s essential to verify availability before making a decision.

Conclusion

Selecting the best Medicare Supplement (Medigap) company requires careful consideration of various factors, including coverage options, costs, customer service, and financial stability. Companies like AARP/UnitedHealthcare, Mutual of Omaha, Cigna, Anthem Blue Cross Blue Shield, and Humana stand out in the market for 2024, each offering unique benefits and considerations.

Ultimately, the best choice will depend on individual needs and circumstances. By conducting thorough research and comparing plans, beneficiaries can find a Medigap provider that offers peace of mind and robust coverage to support their healthcare needs in retirement.