Understanding Health Insurance Costs in 2024 – Health insurance is a critical component of healthcare, providing financial protection against medical expenses. However, the costs associated with health insurance can vary widely based on several factors.

This article delves into the various aspects of health insurance costs, including average premiums, deductibles, and out-of-pocket expenses, while also exploring the impact of subsidies and plan types available in 2024.

Factors Influencing Health Insurance Costs

1. Location

Your geographical location plays a significant role in determining health insurance premiums. Different states and regions have varying healthcare costs, which can affect the price of insurance plans. For instance, urban areas may have higher costs due to increased demand for healthcare services, while rural areas may offer lower premiums.

2. Age and Demographics

Age is another critical factor in determining health insurance costs. Generally, older individuals tend to pay higher premiums than younger individuals. This is because older people may have more health issues that require medical care. Insurers often use age bands to categorize and price premiums accordingly.

3. Tobacco Use

Smoking status can also impact health insurance costs. Smokers typically face higher premiums compared to non-smokers. This is due to the increased health risks associated with smoking, which leads to higher healthcare costs.

4. Plan Type and Metal Tier

Under the Affordable Care Act (ACA), health insurance plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier represents different levels of coverage and costs:

- Bronze Plans: Lowest premiums but highest out-of-pocket costs. They cover about 60% of healthcare expenses.

- Silver Plans: Moderate premiums and out-of-pocket costs, covering roughly 70% of expenses.

- Gold Plans: Higher premiums with lower out-of-pocket costs, covering about 80% of expenses.

- Platinum Plans: Highest premiums but lowest out-of-pocket costs, covering around 90% of expenses.

Choosing a plan type that aligns with your healthcare needs and financial situation is crucial in managing costs.

5. Subsidies and Financial Assistance

The ACA created income-based subsidies to make health insurance more affordable for low- to moderate-income individuals and families. The American Rescue Plan and the Inflation Reduction Act expanded these subsidies, making them available to a broader range of people. These subsidies can significantly reduce monthly premiums and out-of-pocket costs, allowing more Americans to access comprehensive coverage.

Average Costs of Health Insurance in 2024

1. Monthly Premiums

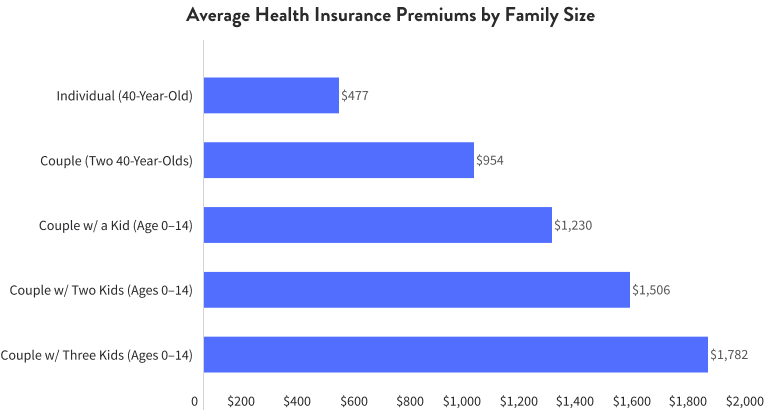

As of 2024, average monthly premiums for individual health insurance plans can vary widely based on the factors mentioned above. According to updated data, here are some average costs:

- Bronze Plans: Approximately $300 – $450

- Silver Plans: Approximately $400 – $600

- Gold Plans: Approximately $500 – $700

- Platinum Plans: Approximately $600 – $800

These averages can fluctuate based on geographic location, age, and other personal factors.

2. Deductibles

Deductibles are the amounts you must pay out-of-pocket before your insurance starts covering costs. In 2024, average deductibles are as follows:

- Bronze Plans: $5,000 – $7,500

- Silver Plans: $3,500 – $5,000

- Gold Plans: $1,500 – $3,000

- Platinum Plans: $0 – $1,500

A lower deductible generally means higher premiums, so consumers must weigh their options based on expected healthcare needs.

3. Out-of-Pocket Costs

In addition to premiums and deductibles, out-of-pocket costs include copayments and coinsurance. These can vary based on the plan type, but here are some general averages:

- Bronze Plans: 30% – 40% coinsurance after deductible

- Silver Plans: 20% – 30% coinsurance after deductible

- Gold Plans: 10% – 20% coinsurance after deductible

- Platinum Plans: 0% – 10% coinsurance after deductible

Choosing the Right Plan

When selecting a health insurance plan, consider the following:

- Evaluate your healthcare needs: Assess your medical history, frequency of doctor visits, and any planned procedures.

- Compare costs: Look beyond premiums to include deductibles, copayments, and out-of-pocket maximums.

- Check network coverage: Ensure your preferred healthcare providers are in-network to minimize costs.

- Utilize resources: Use online tools and calculators available on websites like HealthCare.gov and ValuePenguin to compare plans and costs based on your specific situation.

Conclusion

Understanding the various factors that influence health insurance costs is paramount for making informed decisions. The landscape of health insurance continues to evolve, with subsidies and plan options playing a significant role in affordability.

By considering individual needs and preferences, consumers can navigate the complex world of health insurance and select a plan that meets their healthcare requirements while remaining financially manageable. As open enrollment approaches, being well-informed about these factors will empower individuals to make the best choices for themselves and their families.